Table of Content

If you decide to apply in person, a Home Depot employee will assist you in submitting your application and walk you through any questions you may have. We will never ever recommend a product or service that we wouldn't use ourselves. Compensation may impact how and where products appear on this site, including the order in which they may appear within listing categories. Crediful is committed to helping you make smarter financial decisions by presenting you with the best information possible. We are able to present this information to you free of charge because some of the companies featured on our site compensate us.

If you aren’t sure about something you bought or tend to take longer to return things, this might be the better choice for you. However, the Lowe’s Advantage Card gives you access to cardholder event promotions, like a certain percentage off your purchase. The most recent event in 2020 gave 10% on eligible purchases when charged to the Lowe’s Advantage Card.

Home Depot Vs Lowe’s Credit Card: Which Is Right For You

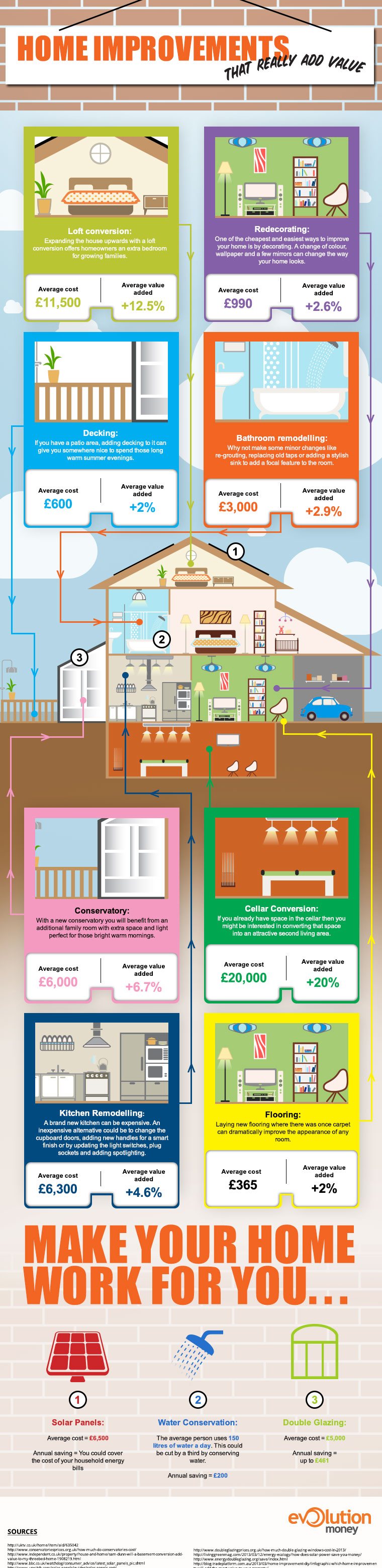

But what if you do not have the required credit score to apply for this card? Worry not, as 007 Credit Agent can help boost your credit score, making you eligible for the Home Depot Credit Card. Not only are you earning up to 5% cash back, but you also have the opportunity to double all of the rewards you earn in one year. Although home improvement stores aren’t part of the calendar, you can still earn 5% back on common purchase categories. That could come in handy, especially on large purchases that you end up regretting later. Well, the way I am, I'd apply for both credit cards, and for me it's just a matter of which one to apply for first.

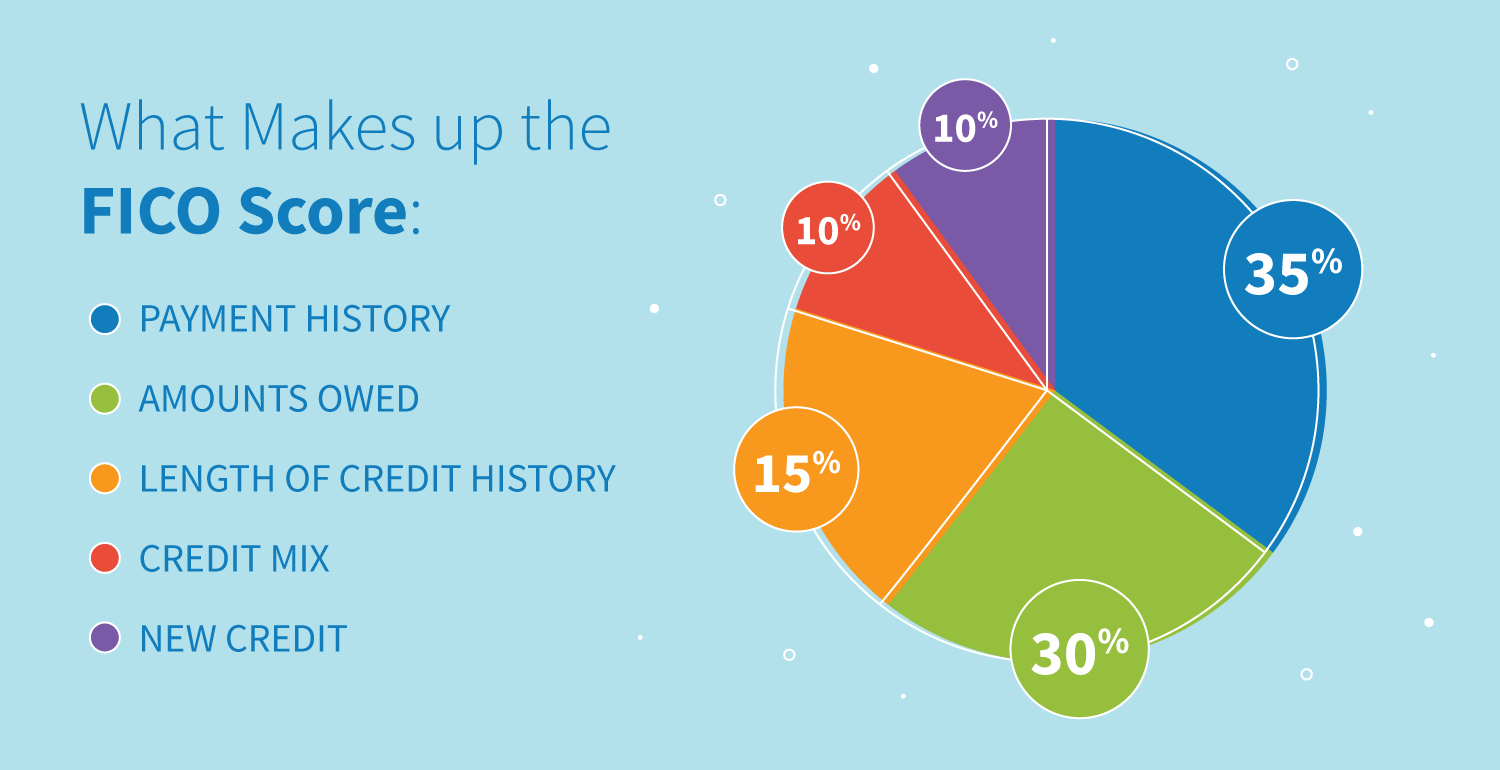

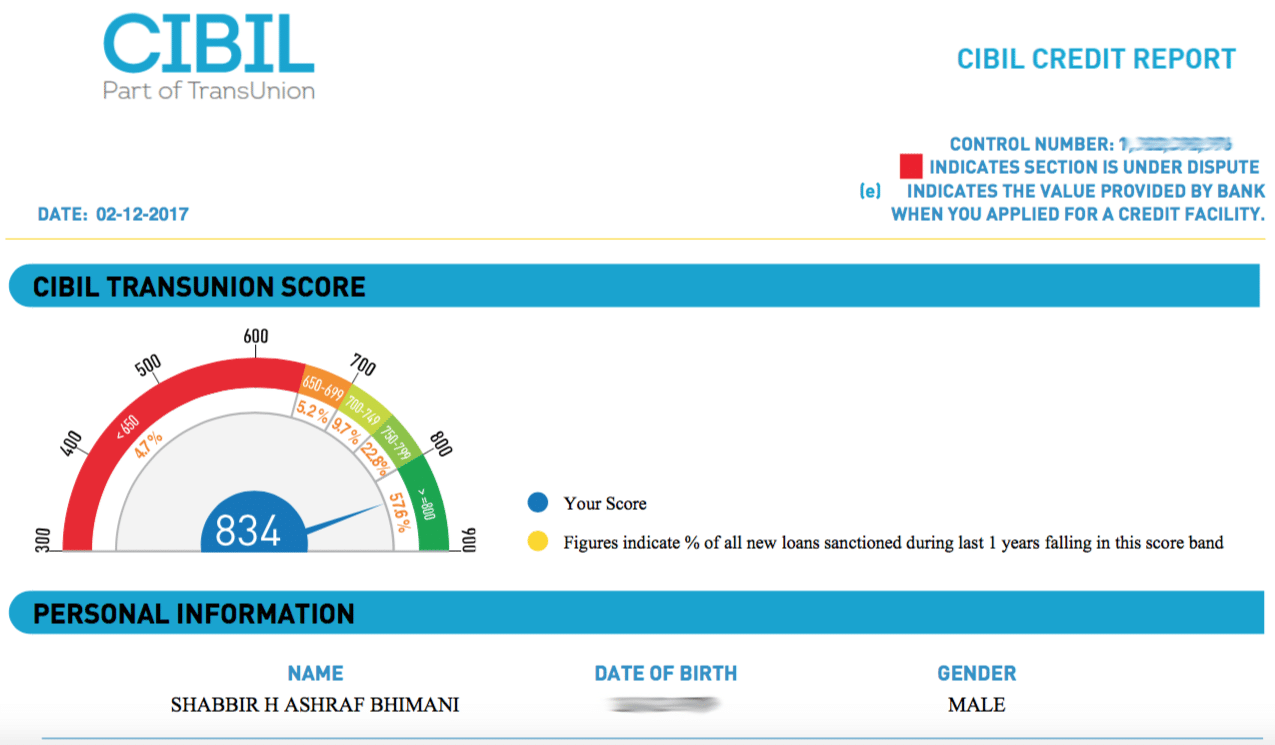

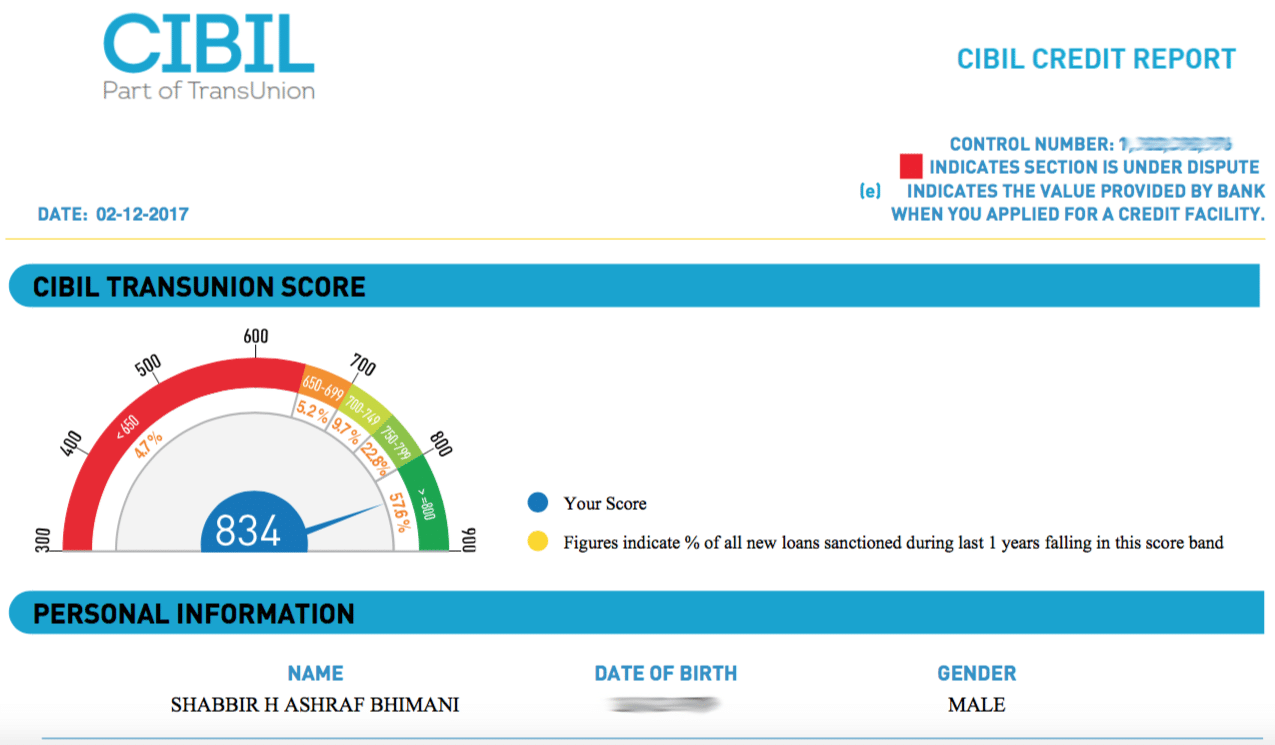

The credit check companies are used to check if the person who is using the credit is approved or not approved. They randomly select Equifax, Experian, or TransUnion to check the applicant's credit. The score ranges from with a score of 90 or above indicating an excellent payment record and a score of below 70 signaling a poor performance. It is critical to understand your Paydex score since it directly influences your ability to obtain financing to fuel the growth of your business.

Home Depot Credit Card: What You Need To Know

When you make certain purchases using the Home Depot Consumer Credit Card, you may be able to get special financing terms. The financing options are time-sensitive, are subject to change, and cannot be combined with other offers. For purchases made at Home Depot, you get 90 days to return items. But if you have the Home Depot Consumer Credit Card, you have up to a year to make returns on purchases made with the card. This store credit card also comes with zero liability protection, so you won't have to pay for unauthorized purchases. You will need a credit score of at least 640 to get it, which is on par with what most store cards require.

You can use all of the Home Depot Credit Cards or credit accounts for qualifying online purchases or at any Home Depot store location. This means these cards cannot be used with other vendors and are “store” or “closed-loop” cards. Specifically for Home Depot’s professional customers, the Pro Xtra Commercial Revolving Charge Card allows authorized employees to use the card for company purchases at any U.S. The Lowe’s Advantage Credit Card is a much better offer from Home Depot’s main competitor.

The Lowes Advantage Card

Sometimes your situation doesn’t fit perfectly into what the bank expects of you. The Money Depot has the flexibility to fit a mortgage around your financial situation, not the other way around. The interest rate goes as high as 26.99% and youll be stung with even greater fees and penalties if you fail to clear your balance and pay the minimum. This involves submitting your personal details and Social Security information for a credit bureau to carry out its determination on your status. As you pointed out, both cards are issued by Citibank divisions, but they still don't function exactly the same. If you don't prefer either store, this Home Depot vs. Lowe's Credit Card comparison can help you choose which card is best for you and your wallet.

This may influence which products we write about and where and how the product appears on a page. Avoid simply financing items that arent useful in the long run, such as a new power tool. It would be best if you only bought those items after paying your monthly bill. If not, you will be charged an APR ranging from 17.99% 26.99%.

How long does it take to get a Home Depot credit card?

Sometimes those decisions will tax your cashflow, and you don’t have time to do the bank’s two-step. At the Money Depot we are business owners helping business owners get the cash they need. If youre applying online, youll be redirected to a THD Loan/GreenSky application page. ZDNET independently tests and researches products to bring you our best recommendations and advice. No, a credit increase on a Lowe's Advantage card won't hurt your credit.

The Home Depot Consumer is one of the more difficult store cards to obtain with poor , as it typically prefers scores above 650. Since The Home Depot Consumer Credit Card does not offer any discounts on purchases, you may want to apply for a cashback credit card instead. The Citi Double Cash lets you Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. The Home Depot’s credit card service system randomly selects from Equifax, Experian, and TransUnion for applicants’ financial information to be sent to. What Home Depot’s automated system will do is allow you to enter credit card information and then pass to credit bureaus for the checks to be completed. Buying a gift card at the home depot is a smart decision since part of the policy through home depot product authority, llc and home depot incentives, inc.

If you’re approved, a Home Depot project loan may come with a fixed interest rate that’s significantly lower than the lowest rate offered by the Home Depot® Consumer Credit Card. Credit Karma isn't a credit bureau, which means we don't determine your credit scores. Instead, we work with Equifax and TransUnion to provide you with your free credit reports and free credit scores, which are based on the VantageScore 3.0 credit score model.

If you own a business and make purchases at Home Depot or Lowe's, both stores offer a business credit card that may be a better alternative to consider. If you have a preference for Home Depot or Lowe's, the decision on a store card is easy. But if you don't, finding the right store credit card for you can be a challenge. When comparing the Home Depot vs. Lowe's Credit Cards, first decide what is most important to you.

No comments:

Post a Comment